Doha Bank Visa Signature Everyday Cashback Credit Card

Your Doha Bank Cashback Credit Card helps you save on your everyday spends such as:

- 10% cashback on Groceries and Online Deliveries for groceries, food & pharmacies.

- 10% cashback on Telco bills (e.g. Mobile phone bills and voucher top ups).

- 10% cashback on Fuel & Ride Hailing Apps (e.g. Petrol Stations and Ride booking Apps).

- 10% cashback on School Fees.

- 50% cashback on Digital Entertainment Subscriptions & Movies. (e.g. online movie subscriptions and movie tickets).

- Earn a total of upto QR 1,400 in monthly cashback with annual savings of up-to QR 16,800.

In addition to this, you can also enjoy travel benefits; such as:

- Contactless payment feature on your card.

- 3DS feature for safe online transactions.

- Airport Lounge Access to 1000+ lounges worldwide.

- Multi Trip Travel Insurance with up to USD $ 500,000 in personal accident benefits including COVID-19 Insurance cover and a lot more.

Looking to save on your increasing grocery expenses? Use your Doha Bank Cashback Credit Card and enjoy up to 10% Cashback on your grocery purchases. You can also enjoy cashback on your online deliveries such as food, groceries & pharmacies.

| Overall Spends | Cashback % | Max Cashback per Month |

|---|---|---|

| QR 2,500 – QR 7,500 | 3% | QR 100 |

| QR 7,500 – QR 15,000 | 5% | QR 200 |

| QR 15,000 or more | 10% | QR 400 |

Illustration

Mr. Ali spends QR 3,000 on groceries and online delivery services using his Doha Bank cashback credit card; with overall monthly eligible spends of QR 8,000. Mr. Ali earns 5% cashback of QR 150 on the above spends.

Calculation: QR 3,000 x 5% = QR 150

Looking to save up on your telco bills ? Use your Doha Bank Cashback Credit Card to pay for your mobile phone bills, top ups and home broadband and save up-to 10% as Cashback.

| Overall Spends | Cashback % | Max Cashback per Month |

|---|---|---|

| QR 2,500 – QR 7,500 | 3% | QR 100 |

| QR 7,500 – QR 15,000 | 5% | QR 200 |

| QR 15,000 or more | 10% | QR 200 |

Whether you are re-fuelling your car for that long trip or booking a ride for your family; your Doha Bank Cashback Credit Card now rewards you with upto 10% cashback when you use your card to pay for fuel at gas stations or for your ride bookings.

| Overall Spends | Cashback % | Max Cashback per Month |

|---|---|---|

| QR 2,500 – QR 7,500 | 3% | QR 100 |

| QR 7,500 – QR 15,000 | 5% | QR 200 |

| QR 15,000 or more | 10% | QR 200 |

Paying your child’s School Fees was never this convenient and rewarding. Receive up to 10% Cashback on school fee payments when you use your Doha Bank Cashback Credit Card and save on your child’s school fee expenses.

| Overall Spends | Cashback % | Max Cashback per Month |

|---|---|---|

| QR 2,500 – QR 7,500 | 3% | QR 100 |

| QR 7,500 – QR 15,000 | 5% | QR 200 |

| QR 15,000 or more | 10% | QR 400 |

You also have the option of converting the school fees charged to your cashback credit card into a 6 months 0% monthly installment plan with Zero processing Fee.

You can also get 50% cashback on digital entertainment subscriptions as well as on movie ticket purchases while enjoying your favourite movies or TV shows.

| Overall Spends | Cashback % | Max Cashback per Month |

|---|---|---|

| QR 7,500 -< QR 15,000 | 50% | QR 100 |

| QR 15,000 or more | 50% | QR 200 |

| Retail Spend Requirement | Max Cashback per Month | ||||

|---|---|---|---|---|---|

| Overall Retail Spends | Cashback % | Grocery & Online Delivery | Telco Bills | Fuel & Ride Hailing Apps | School Fees |

| QR 2,500 – QR 7,500 | 3% | QR 100 | QR 100 | QR 100 | QR 100 |

| QR 7,500 – QR 15,000 | 5% | QR 200 | QR 200 | QR 200 | QR 200 |

| QR 15,000 or more | 10% | QR 400 | QR 200 | QR 200 | QR 400 |

| Max Cashback per Month | ||

|---|---|---|

| Overall Retail Spends | Cashback % | Digital Entertainment & Movies |

| QR 7,500 -< QR 15,000 | 50% | QR 100 |

| QR 15,000 or more | 50% | QR 200 |

| Examples | ||||

|---|---|---|---|---|

| Grocery & Online Delivery | Telco Bills | Fuel & Ride Hailing Apps | School Fees | Digital Entertainment & Movies |

| Lulu Hypermarket | Ooredoo | Woqood | Gems | Netflix |

| MonoPrix | Vodafone | Uber | Newton | Amazon Prime |

| Al Meera | Careem | Sherborne | ||

Features & Benefits

Global Travel Benefits

12 complimentary airport lounge visits for cardholder only to 1000+ premium Lounges per year at key airport lounges worldwide, no matter what airline or travel class you have booked.

- No registration required to activate the lounge benefit on the Cashback Credit Card.

- Customers will only need to create login details if they wish to download the app.

- The Cardholder is entitled to 12 lounge visits (Cardholder only) in a calendar year.

- To be eligible for the complete entitlement of 12 visits, the Cardholder needs to complete one (1) international transaction in each calendar year.

- Minimum international transaction value of USD 1 at Point-of-Sale transactions including Face to Face, e-Commerce, MOTO or Recurring transactions where Issuer is not located in the country of transaction; Spend may take up to 10 days to register with LoungeKey.

- The Cardholders will be initially assigned one (1) complimentary visit each year prior to meeting the Eligibility Condition.

- Upon successfully satisfying the Eligibility Condition, the Cardholder becomes eligible for the 11 additional visit entitlements for the year.

- Annual lounge visit entitlement and the requirement to meet the Eligibility Condition will reset from 1 January in subsequent years.

- As part of the default option, any lounge visits outside Visa Lounge Entitlement will need to be paid for by the Cardholder (Visit will be charged directly to the card by LoungeKey).

For further information, please visit www.loungekey.com/visamena and for Terms of Use please visit www.dohabank.com

Up-to 12% Discount with Agoda

Agoda provides access to 985,000+ hotels and vacation rentals globally.

- Simply need to visit www.agoda.com/visamena and at point of payment input your eligible Doha Bank Cashback Credit Card to receive the discount.

- Discount applies only to properties listed as ‘Promotion Eligible’ and when booking through the dedicated URL.

- The Promotion discount is 12%.

- Discount is applied at point of payment when inputting your Doha Bank Cashback Credit Card.

Visa Luxury Hotel Collection

The Visa Luxury Hotel Collection comprises of 900 premium properties around the world that you can book for a holiday.

Enjoy the following benefits and offers when booking through www.visaluxuryhotels.com

- Best available rate guarantee.

- Automatic room Upgrade upon arrival.

- Complimentary in-room Wi-Fi.

- Complimentary continental breakfast daily.

- $25 food or beverage credit.

- VIP guest status.

- 3pm check out upon request.

Visa Terms and Conditions Apply.

YQ Meet and Assist

YQ is a global network of specialist airport meet & assist service partners. For Doha Bank Cashback cardholders it means that getting through airports can be a personalized, pleasant experience they deserve.

- Up to 20% off on published rates for Doha Bank Cashback Credit Cards at over 450 destinations globally

- Doha Bank Cashback Cardholders can book via https://cemea.yqnowgroup.com/ and the applicable discount is applied directly to the transaction.

- Clearance through customs and immigrations.

- Booking for the services must be made at least 72 hours prior to commencement of travel.

- Offer not to be used in conjunction with other promotions.

- Cardholders can also book other services such as limo transfer, visa on arrival, baggage porters, etc.

Avis Car Rental

Avis Car Rental one of the world’s best-known car rental brands with a truly global footprint is now easily accessible with your Doha Bank Cashback Credit Card. Enjoy hassle free access to a car of your choice when travelling abroad.

- Up to 35% discount on Standard Rates, and up to 30% off on Retail Rates.

- Simply visit www.avisworld.com/visa to avail the offer.

- You can also enroll for Avis Preferred Plus Membership free of charge and enjoy additional services including free drivers.

Multi Trip Travel Insurance

With Multi-Trip Travel Insurance, you and your family is covered on all trips with a maximum trip duration of 90 days including COVID 19. So now you can simply focus on enjoying every single moment of your travel experiences.

Following are the Details of the cover:

- Personal Accident Benefits up to US$ 500,000 (International).

- Personal Accident Benefits up to US$ 50,000 (Domestic).

- Emergency Medical Expenses up to US$ 500,000.

- Evacuation and Repatriation Expenses up to US$ 500,000.

- Hospital Daily Cash $50 per day up to US$ 1,500.

- Trip cancellation / curtailment up to US$ 5,000.

- Delayed departure US$ 42 per hour up to US$ 1,000.

- Missed Departure benefit up to $1,000.

- Missed Connection Benefit $500.

- Baggage delay US$ 42 per hour up to US$ 500.

- Loss of personal belongings up to US$ 1,000.

- Covers cardholder, spouse and up to 5 children; Maximum age limit 80. Restricted age limit for children.

For more information please visit https://cardholderbenefitsonline.com

Medical and Travel Assistance

With your Doha Bank Cashback Credit Card enjoy your travels with peace of mind, regardless of where your journey takes you.

You can avail the following services such as:

- Telephone medical advice.

- Medical service provider referral.

- Essential medicine and equipment delivery.

- Dispatch of physician to cardholder location.

- Medical evacuation and repatriation.

- Legal referral.

- Interpreter referral.

For more information please visit https://cardholderbenefitsonline.com

The 24-hour concierge provides a personal service to Doha Bank Cashback Cardholders, taking care of all the details so they can simply take their seats and enjoy.

- Restaurant advice.

- Booking tables, including those that are hard-to-get.

- Travel arrangements: booking flights, hotels, car rental, hotel transfers, tourist advice.

- Shopping recommendations, sourcing a product.

- Arranging a special gift, sending flowers.

Concierge Digital Services

As a Doha Bank Cashback cardholder, you now have access to a digital concierge channel in addition to telephone and email service. The digital concierge is a fully mobile responsive portal, enabling you to search and book on-the-go. You will also be able to talk to our Lifestyle Managers any time of day and night via the Live Chat!

Visit www.visaconciergecemea.com to access the online platform and discover:

- Browse and book flights, hotels , car rental on-the-go.

- Reserve tables online via a click of button in premium restaurants, including those that are hard-to-get.

- Select and book tickets & hospitality packages for most exclusive music, theatre and sporting events.

- Browse through the collection of benefits covering vast range of products and services.

The Digital Concierge platform is available to cardholders in English, Arabic, French. Cardholders to register directly on the platform by visiting www.visaconciergecemea.com.

If you are registered previously with the concierge, you can call concierge to have an activation email sent.

Concierge WhatsApp Services

As a Doha Bank Cashback cardholder, you now have access to a WhatsApp concierge channel in addition to telephone, email and digital concierge . You will be able to chat to our Lifestyle Managers any time of day and night via the Live Chat!

Simply add the provided phone numbers to your contact list and start the chat :

- For English: +44 7874 023129.

- For French: +44 7520 631646.

- For Arabic: +44 7520 631645.

- The first chat will contain Terms and Conditions (disclaimer).

- The concierge service requests your first and last name and email/Member ID in a response message to verify identity.

New Users :

- Concierge replies through WhatsApp with a request for a phone call. You need to call back and provide telephone number for further communication between concierge and yourself. This is to verify your card number and complete your profile and registration.

Lifestyle Benefits

Get more out of Anghami Plus membership, the first Arabic music streaming platform with your Doha Bank Cashback Credit Card.

As a Doha Bank Cashback Cardholder you can get up to 4 months of free Anghami Plus membership per year when paying with your Doha Bank Cashback Credit Card. Get the first month of Anghami Plus membership free of charge, and an additional month free of charge for every two consecutive paid months.

How to use

- Go to Anghami website ( www.anghami.com/visa) and select the Visa offer.

- Register (if using the service for the first time) or log in using Anghami account.

- Enter your Eligible Doha Bank Cashback Credit Card, as recurrent payment mode, and any other relevant details on the website.

- Avail the benefit on the spot.

- Enjoy unlimited online and offline music streaming.

Celebrate it all, download the ‘xperience with the ENTERTAINER’ app, then enter your eligible 16-digit Doha Bank Cashback Credit Card number to register. You can enjoy 3 offers at 30 selected merchants with redeemed offers renewed on quarterly basis. In addition to the existing buy-one-get-one-free (BOGOF) offers, the app will present cardholders access to explore over 5,000 new and dynamic deals, including 2-for-1 offers, at home and abroad.

How it works

Existing users of Visa Offers MENA app: When you open the Visa Offers MENA app, you will receive a notification that will direct you to the new ‘xperience with the ENTERTAINER’ app. Your existing username and password for the Visa Offers MENA app will be valid to log in to the new app.

New users: Download the ‘xperience with the ENTERTAINER’ app, then use the eligible 16-digit Visa card number to register.

Shopping Benefits

Buyers Protection provides you with extra peace of mind when purchasing an eligible item. Use your Doha Bank Cashback Credit Card to pay for an Eligible Item, purchased in-store or online and receive complimentary Buyers Protection Insurance, providing cover for theft, accidental damage or non-delivery of eligible purchases, subject to the Terms and Conditions of the policy.

- Full payment of purchased items must be made with your Doha Bank Cashback Credit Card either in store or online.

- New item purchases only.

- Coverage for a maximum of 365 days from date of purchase.

- Only coverage for Accidental Damage in respect of mobile phones.

- 28 days from incident date to submit a claim but Cardholder must report within 24 hours of discovery in case of theft.

- Particular limits apply to online purchases that are not delivered or damaged in transit.

- Please refer to the terms and conditions for full policy details, including cover, conditions, limits and exclusions.

For more information please visit https://cardholderbenefitsonline.com/.

Extended Warranty adds real value to your Doha Bank Cashback Credit Card. It doubles the repair period offered by the original manufacturer’s warranty for up to 1 year.

Applicability:

- Full payment of purchased items must be made with Doha Bank Cashback Credit Card.

- New item purchases only.

- Proof of full payment with Visa Signature is required.

With your Doha Bank Cashback Credit Card, you will be protected against unauthorized transactions or fraudulent use of your card by unrelated third parties. This insurance benefit will provide reimbursement up to USD 2,500 per occurrence with USD 4,000 annual aggregate limit for you as a Doha Bank Cashback Cardholder.

Cover applies to:

Unauthorized charges for which cardholder is responsible that occur 48 hours prior to the cardholder first reporting loss or theft of their Doha Bank Cashback Credit Card to the Bank.

Unauthorized charges incurred in the two (2) months prior to the cardholder first reporting the event to the Bank made while the card remained in the cardholder’s possession through:

- in-store,

- telephone,

- ATM withdrawals,

- on-line purchase(s), by using Cardholders’ eligible card information.

Charges incurred by a resident of Cardholder’s household or by a person entrusted with their card or losses that result from or are related to business activities are not covered.

Principal conditions include:

- Cardholder must report unauthorized charges, loss or theft of the card to the Bank immediately and provide written notice of the claim within 30 days.

- For potential claims advices, Cardholder should follow the instructions described on the benefits portal and within their benefit terms and conditions.

- Cardholder accounts must be valid and in good standing for coverage to apply.

Please refer to the terms and conditions for full policy details, including cover, conditions, limits and exclusions.

For more information please visit https://cardholderbenefitsonline.com/.

Additional Benefits

Chip and PIN (Personal Identification Number) is a smart card payment system that provides an extra level of security on your credit card. You will be required to enter your PIN to complete your transactions. Your PIN is important because it limits the risk of fraud on your card and helps give you extra peace of mind.

Your PIN will be received along with your credit card. However; if your wish to change your PIN you can visit any of our nearest ATMs. In case of lost PIN all you need to do is contact our 24/7 helpline at 4445-6000 or your branch and you can collect your PIN from your desired branch or card centre within 2 business days.

This will be the typical scenario when paying for your purchases:

- Hand over your Doha Bank Cashback Credit Card to the cashier.

- The cashier will insert your credit card into the card reader and key in the payment amount.

- You will be handed the card reader for you to verify the amount.

- Enter your 4-digit PIN. Please keep the keypad covered so that no one can see your PIN.

- Once your PIN has been accepted, a transaction slip will be printed.

- Your credit card will be handed back to you along with transaction slip once your transaction is complete.

What if the merchant does not have a Chip and PIN device?

While most merchants are already equipped with Chip-and-PIN-enabled devices, there are still some who have yet to upgrade. When you encounter such merchants, your Doha Bank Cashback Credit Card’s magnetic strip will be swiped, and you will be asked for your signature. Please note, that more and more merchants are being equipped to have Point of Sale terminals that allow credit cards to read the information on the chip located on the front of the credit card.

What if someone asks me for my PIN?

Kindly remember that Doha Bank or any of our representatives will never ask for your PIN, no matter what the situation may be. Your PIN is very valuable, and we strongly recommend no one but you know it. Also know that writing it down could increase the risk of someone finding out what your PIN is. Should you ever believe that someone other than you might know your PIN, please contact us immediately.

Won’t people be able to see me enter my PIN on the PIN device?

Please take every precaution possible to ensure no one sees the digits you enter on the PIN device. Some of our recommendations to prevent other people seeing your PIN being inputted include shielding the number pad with your other hand and tilting the device away from any person around you. We cannot stress enough how important it is to ensure that only you know your PIN.

Will I be held liable if my Chip and PIN card is lost or stolen?

In the unfortunate event that your credit card is lost or stolen, please notify us immediately by calling 4445-6000. You will not be liable for any transaction that is made after you report your card lost or stolen to us. The SMS notifications on your Doha Bank Cashback Credit Card, is to keep you informed of any activities on your credit card(s).

3D Secure when paying online!

The 3D Secure™ feature offers enhanced security when you pay online with your Doha Bank Cashback Credit Card on websites. This ensures that only you as the credit cardholder will be able to complete the online transaction.

How does it work?

- After entering card details, you will be forwarded to 3D secure page (if merchant is enrolled for 3D secure program).

- A One Time Password (OTP) is sent to your mobile number and email ID (as registered in our records).

- Enter the OTP to complete the transaction.

If you have not received OTP on your bank registered mobile number or email ID, please contact our 24 x 7 customer service number +974 44456000.

Contactless Payments

Pay on the go ! Now you can make quick, easy and convenient contactless payments using your Doha Bank Cashback Credit Card. To learn more click here.

Use your card to withdraw cash up to your allowed cash limit from any ATM around the world with the VISA® logo, and never worry about not having cash when you need it again.

If you would like to share the benefits and privileges that you enjoy on your Doha Bank Cashback Credit Card with your loved ones, simply apply for a supplementary card.

- Easy and simple application process – call us to apply or simply apply online at www.dohabank.com.

- Quick processing and delivery – with minimal documentation required.

- Supplementary cards for your immediate family members.

- Convenient – as the primary cardholder, you have the option to set separate credit limits from your basic limit on your supplementary card(s).

To apply for your supplementary card(s) and for more information, please call us on our 24/7 helpline at 4445-6000, or at +974-4445-6000 if you are outside Qatar.

Complimentary SMS alerts on your mobile phone regarding instant notifications of all your credit card transactions.

Register for e-Statements by placing your request on DBank Online and receive your statements electronically and free of charge, as well as doing your part for the environment by going paper-free!

Protect your credit card

- Do not share your PIN with anyone.

- Report lost/stolen/damaged cards immediately.

- Only use your card online with secure websites.

- Never give your card information when in doubt.

- When you receive a new card, destroy your old card by cutting it in half.

- Make sure that you sign any receipts (if required) with the same signature on the back of your card.

- Report any suspicious activity to us immediately.

- Retain all transaction receipts until they are reflected in your statement.

Caring for your credit card

- Do not bend your card or leave it exposed to sunlight.

- Do not scratch the magnetic strip.

- Do not place two cards with magnetic strips together.

- Do not leave your card on or near any electronic gadget.

Before you start using your Doha Bank Cashback Credit Card

Your credit card will need to be activated once you are in receipt of your card. If you wish to use your credit card immediately, whether for physical use locally or internationally or online once you receive it, please call us on (+974) 4445-6000 and we will activate your card on the spot.

- Read the ‘Credit Card Terms and Conditions’ on the credit card application form before signing and the online ‘Schedule of charges’ by visiting www.dohabank.com

- Sign your credit card with a ballpoint pen. The signature panel is found on the back of your credit card. Signing your credit card will prevent any possible misuse.

- To reissue your PIN please log on to your DBank Online and place a service request and the PIN will be sent to your branch or card centre as per your request.

- Keep a photocopy of the front and back of your credit card(s) for your records, once you have signed on the signature panel.

- Ensure you do not keep your PIN with your credit card and do not disclose your PIN to anyone.

- Ensure your personal information is always up to date and please keep us informed of any changes in your particulars, such as address, telephone number(s), or email when change occurs.

- Quote your 16-digit credit card account number in all correspondence and payments.

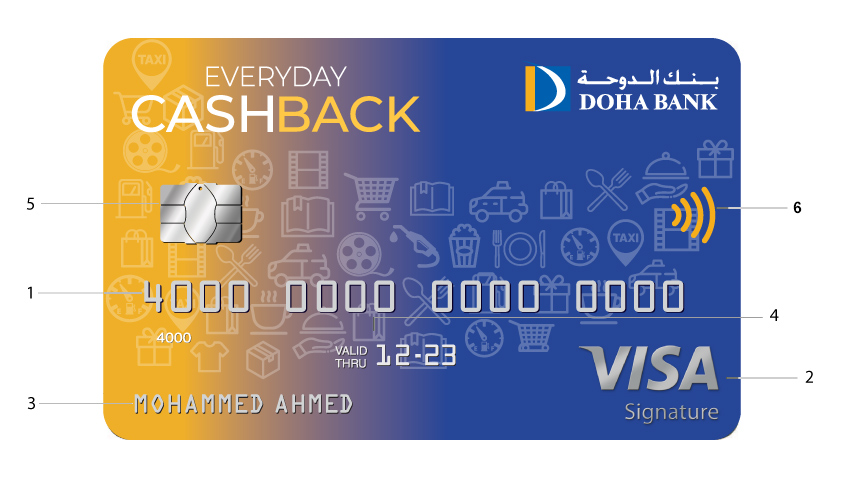

Know your Doha Bank Cashback Credit Card

Front:

- Your 16-digit credit card number will be embossed here.

- Your credit card is accepted at all ATMs and retail stores around the world that display the VISA® logo.

- Your name should be accurately embossed on your credit card, for you are the only person authorised to use it. If your name is embossed incorrectly, please contact us immediately.

- Your credit card expiry date embossed here as ‘VALID THRU’ shows the period up to which you may use your credit card. This extends up to the last day of the month shown. You will be sent a renewed card before this date. Please do not use the old card once your new card has been activated.

- Your Smart Chip holds vital data and is designed to make transactions even more secure.

- The contactless logo on your card means that your card is enabled for contactless payment. Always tap the Point of Sale terminal with the reverse side of the card when making a contactless transaction.

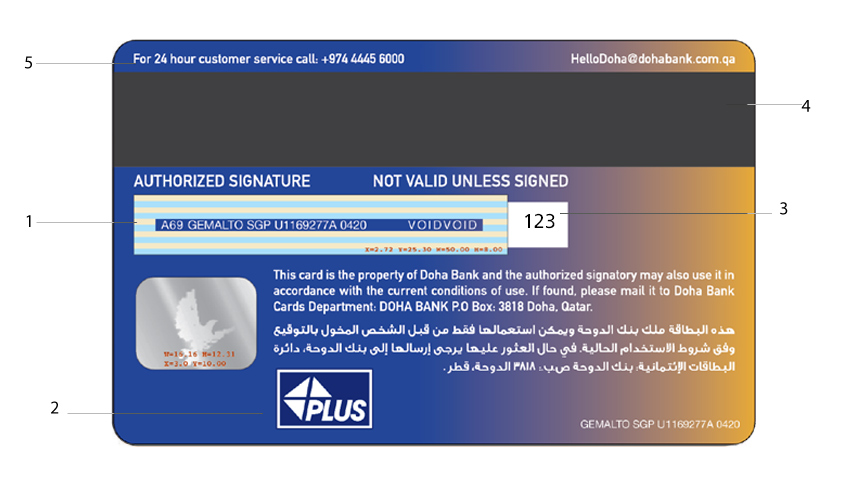

Back:

- Your signature panel is the white area above. Please ensure you sign on it before you start using your card.

- Your credit card is accepted at all ATMs around the world that display the Plus logo.

- Your unique credit card verification value is embossed here. This 3-digit verification value is required to make online payments. Please do not share this number with anyone.

- Your magnetic strip contains coded information for the security of your credit card.

- Your key contact number for all credit card-related enquiries.

Eligibility Criteria

- Minimum Monthly Income: QR 15,000.

- Minimum deposit for Secured Card: QR 30,000.

Cashback Terms and Conditions

- Customer has to meet the minimum monthly retail spend of QR 2,500 to start earning cashback.

- Retail spend means transactions at Point of Sale terminals and online transactions.

- Each spend category has a cashback earning % subject to spend slabs.

- Each spend category has a monthly maximum cashback cap.

- Maximum cashback that a customer can earn per month is QR 1,400 under all categories combined.

- The cashback earned will be credited to the customer’s cashback credit card within two working days from the monthly card statement billing date.

- Once the Cashback is credited the same will reflect in the next month’s credit card statement.

- The description of the spend categories provided in the cashback earn table is generic. Only retail transactions made under specific spend categories will be eligible for earning cashback. Doha Bank is not responsible if a retail transaction does not get captured under the appropriate spend category or if any merchant has a different spend category compared to the one categorized by card schemes. The bank’s decision on calculation of cashback earnings and spend tier eligibility shall be final, conclusive and binding on the card customer.

- Cash withdrawals & Remittances, instalment plans, fees & charges and transactions reversed by the merchants will be excluded from qualifying spend calculation.

- The calculation of cashback earnings and spend tier eligibility considers only posted transactions in customer’s cashback credit card. If a transaction is made on or close to card monthly statement billing date but not posted in the current month statement, then the transaction will be considered for calculation of cashback earnings and spend tier eligibility in the following month statement.

- Spends on supplementary cards will be considered for calculation of cashback earnings and spend tier eligibility of primary card. However, cashback earnings will be credited to primary card.

- Online deliveries means groceries, food, pharmacies only.

- Digital entertainment subscriptions means streaming services for Movies and TV only.

- Fraud and / or abuse relating to earning of cashback may result in forfeiture of the cashback as well as termination and cancellation of the card.

- The bank reserves the right to cancel, suspend, change or substitute the cashback or the cashback conditions or the basis of computation of cashback or terms and conditions of the cashback card at any time.

Apply for Doha Bank Visa Cashback Credit Card

Note:

Doha Bank’s retail, commercial and corporate products are granted at our sole discretion and are subject to the Bank’s terms, conditions and acceptance.