A leading Private Sector Investor has joined the Doha Bank family

Doha Bank announced that one of Qatar’s leading investors had acquired a portion of the Qatar Investment Authority’s stake in the Bank, a step that reflects growing confidence in Doha Bank’s performance and outlook.

Sheikh Abdulrahman bin Fahad bin Faisal Al Thani, CEO of Doha Bank Group, affirmed that this development reflects the private sector’s confidence in the transformative strategy adopted by the Bank’s new management over the past twelve months, leading to tangible improvements in both financial and operational performance. The new strategy marked a pivotal turning point in the Bank’s trajectory by enhancing operational efficiency, strengthening growth indicators, and further bolstering the governance framework, thereby contributing to the establishment of Doha Bank as an attractive financial institution for investment both locally and internationally.

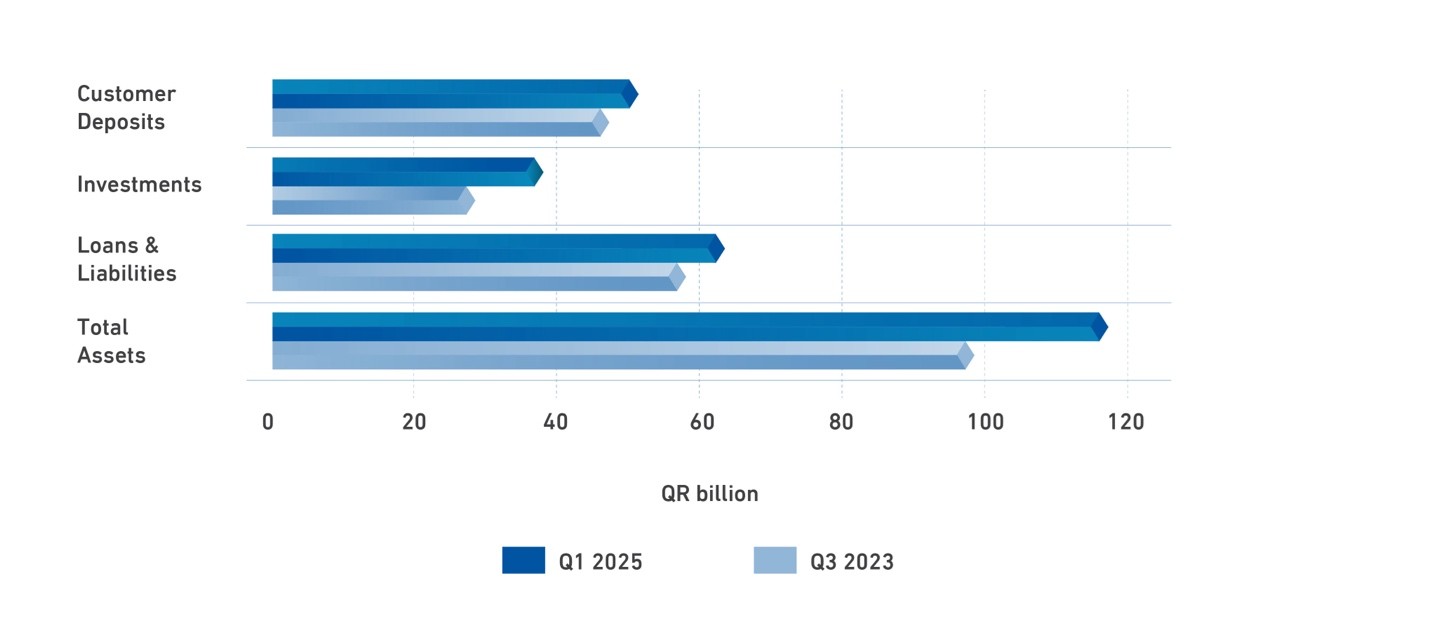

The GCEO further noted that since the implementation of the new strategy, the Bank’s assets have grown by approximately 20%, rising from QR 96.3 billion to QR 115.3 billion. This includes an increase in loans from QR 56.6 billion to QR 61.8 billion, driven by robust growth in both the corporate and government lending portfolio, as well as the housing loan portfolio. Additionally, the investment portfolio expanded from QR 27.3 billion to QR 36.6 billion, driven by an increase in the bond portfolio, which primarily comprises highly rated securities.

On the liabilities side, Doha Bank recorded a notable increase in customer deposits, rising from QR 45.3 billion to QR 50.1 billion. In 2025, the Bank also issued international bonds worth USD 500 million, one of the most successful issuances by financial institutions in the region. The Bank attracted investors from Europe and Asia, achieving one of the highest distribution rates to investors outside the Middle East, with 55% of total bond demand coming from international markets. Furthermore, the Bank recently secured a syndicated loan of EUR 500 million at the lowest borrowing cost in its history, marking its first syndicated loan in euros. These achievements reflect the Bank’s funding and liquidity strategy, which is anchored in the principles of diversification and sustainability.

These achievements have positively impacted the Bank’s share price, which surged from QR 1.37 to the current level of QR 2.44. These results have also attracted a broad segment of foreign investors and global asset managers to invest in the Bank’s shares.

In conclusion, the management of Doha Bank extended its sincere appreciation to the Qatar Investment Authority and the Qatar Central Bank for their continued support. The Bank reaffirmed its openness to all investment opportunities and its ongoing commitment to further developments and innovations that strengthen its position and support sustainable growth. The management views this investment as a vote of confidence in the Bank’s strategy from the private investment sector. In recognizing this confidence as an additional responsibility, the Bank remains committed to consistently meeting the expectations of its shareholders and investors.